2022-11-02

REDINGTON - STOCK ANALYSIS FOR SWING TRADE

From last one month this stock has been trading in a narrow range of Rs 135-143 levels. Today it gave clean breakout from mentioned range with heavy volume . & also closed above all 3 MA 50,100,200 which reflects this stock in buying radar till 167 with support at 135 .

2022-11-01

PUDUMJEE PAPER PRO

This Stock has given Breakout from one year of consolidation with heavy volume. The primary trend is bullish and there is a breakout of a Bullish Flag formation on the weekly time frame, which may lead to a fresh expansion phase. The previous breakout range of Rs 48-46 will now act as an immediate support zone. Momentum indicators are positively poised to support the current momentum. On the upside, Rs 88 looks like an imminent target while it has the potential to move further higher in the medium term. it can be accumulated again at 46.85 levels .

2022-10-10

BANKNIFTY ANALYSIS FOR WEEK 10 OCT TO 14 OCT

BANKNIFTY IS FORMING ASCENDING TRIANGULAR PATTERN BY TAKING RESISTANCE AT 39650 & LOWER TRENDLINE ACTING AS SUPPORT . IF IN THIS WEEK BANKNIFTY MANAGES TO START TRADING ABOVE 39650 THEN 40000 IS ACHIEVIABLE . OR IF BANKNIFTY BREAKS BELOW TRENDLINE SUPPORT WITH BUILD UP , THEN BANKNIFTY WILL BECOME WEAKER FOR LONGER TERM

2022-09-29

BANKNIFTY ANALYSIS

BANKNIFTY LOOKS ITS FORMING DESCENDING PARALLEL CHANNEL & SINCE ITS FORMING IN SHORT TERM DOWNTREND , ONE SHOULD LOOK FOR BUYING OPPURTUNITY . IF BANKNIFTY BREAKS ABOVE PARALLEL CHANNEL , THEN ONE CAN TAKE LONG POSITION TILL 38700 WITH STRICT STOP LOSS AT 37650 .

2022-09-08

BANKNIFTY ANALYSIS

BANKNIFTY CLOSED ABOVE STRONG RESISTANCE AT 40160 MARK . FROM THIS LEVEL BANKNIFTY LOOKS 40800 IS REACHABLE . ALL FINANCIAL STOCKS CLOSED WITH STRONG MOMENTUM .

2022-08-29

BANKNIFTY ANALYSIS - GAP FILLING TRADE

TODAY BANKNIFTY TAKEN SUPPORT AT PREVIOUS SUPPORT AT 37950 , AND FULL DAY TRADED IN RANGE MARKET . TOMORROW , IF BREAKOUT HAPPENS THEN TODAYS OPENING GAPDOWN MAY GET FILLED . TRADE PATTERN - GAP FILLING TRADE ENTRY - ABOVE 38400 TARGET - 38900 STOPLOSS - 38250

2022-08-25

NIFTY - TRADE ANALYSIS FOR SEPTEMBER EXPIRY

TODAY MONTHLY EXPIRY ENDED IN RED & PROFIT BOKKING ALSO HAPPENED . FOR SEPTEMBER MONTH , ANY NEGATIVE PATTERN AT RESISTANCE ZONE 17640- 17690 WILL GIVE AN OPPURTUNITY TO CREATE SHORT POSITION FOR HOLDING POSITION TILL 17200 .

2022-08-19

NIFTY ANALYSIS - PARALLEL CHANNEL BREAKDOWN

FINALLY TODAY NIFTY SHOWED NEGATIVE SIGN & GOT BREAKDOWN FROM PARALLEL CHANNEL , CLOSED AT 17726 TRADE PATTERN - PARALLEL CHANNEL BREAKDOWN TRADE - POSITIONAL TARGET - 17350 STOP LOSS - 17850

2022-08-10

BANKNIFTY - SWING POSITION

TODAY , BANKNIFTY GAVE CLOSING ABOVE STRONG RESISTANCE 38250 . FROM NOW WE CAN LOOK FOR BUYING OPPURTUNITY TILL 39500 .TECHNICALLY ITS A BREAK OUT FROM CONSOLIDATION RANGE . IN THIS SCENARIO , PREVIOUS TREND WILL CONTINUE .

2022-08-03

BANKNIFTY ANALYSIS

BANK NIFTY - TODAY BANKNIFTY TAKING SUPPORT AT TRENDLINE ( BLACK COLOUR ) ,& ITS ALREADY TESTED 4 TIMES , IT BECOME WEAK NOW . ANY TIME IF TRENDLINE BREAKS , THEN ONE CAN TAKE SHORT POSITION TILL 37300 .

2022-07-27

NIFTY ANALYSIS - DAY BEFORE US FED RATE HIKE

RESISTANCE @ 16730 SUPPORT ZONE @ 16440 - 16490 ONE DIRECTION MOVE CAN BE EXPECTED ON EITHER SIDE , IF GIVEN SUPPORT OR RESISTANCE BROKEN .

2022-07-18

BANKNIFTY ANALYSIS

BANKNIFTY - EXPECTING BN WILL TOUCH 36000 LEVELS , & THAT LEVEL WILL DECIDE MARKET DIRECTION FOR COMING WEEKS . IF BN START CONSOLIDATING FOR 1 WEEK AT 36000 MARK & GAVE BREAKOUT WITH BULLISH CANDEL , THEN DEFINITELY 38000 LEVELS WILL LOOKS EASIER .

2022-07-13

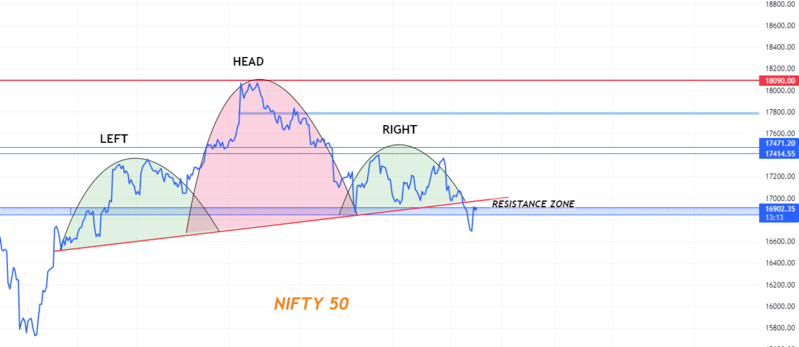

BANKNIFTY - HEAD & SHOULDER PATTERN

TODAY , BANK NIFTY FORMED HEAD & SHOULDER PATTERN FORMATION IN 30 MIN TIME FRAME . * ITS EASY TO FIND PATTERNS IN LINE CHART . * ONCE U FOUND , CONVERT LINE CHART INTO CANDEL CHART . * DRAW PROPER SUPPORT & RESISTANCE * WAIT TO GIVE BREAKOUT & RETEST NECK LEVEL * ONCE NECK LEVEL RETESTED , ENTER THE TRADE & KEEP SL ABOVE NECK LEVEL & TARGET TO NEXT SUPPORT .

2022-06-28

NIFTY ANALYSIS

IF NIFTY MANAGE TO TRADE ABOVE 15930 LEVELS FOR 1 HOUR , THEN IT MAY TRY TO FILL THE GAP AT 16150 .

2022-06-20

NIFTY ANALYSIS

NIFTY IS CONSOLIDATING IN 15200 TO 15400 RANGE . ANY BREAKOUT FROM 15400 LEVEL WILL TAKE NIFTY TO 15650 . IF IT BREAKDOWN FROM 15200 WILL DRAG NIFTY TILL 14750 IN COMING DAYS

2022-06-18

NIFTY - WEEKLY ANALYSIS

2022-06-10

BANK NIFTY - WEEKLY ANALYSIS - 13 / JUNE TO 17 / JUNE

BANKNIFTY BROKEN MAJOR SUPPORT ZONE 34670 -34790 WHICH MAKES BANKNIFTY WEAKER . RBI REPO HIKE , RAISING CRUDE OIL PRICE , HIGH INFLATION RATE & UNSETTLED GEOPOLITICAL TENSION DRAGING ALL GLOBAL INDICES DOWN .EXPECTING FURTHER FALL IN BANKNIFTY TILL 34000 IN NEXT WEEK .

2022-06-06

MARKET OVERVIEW - 06/JUNE

NIFTY - NIFTY OPENED SLIGHTLY GAPDOWN & ROSE GRADULLY BY TAKING SUPPORT AT 16440 LEVELS . NOW NIFTY MADE A STRONG SUPPORT ZONE 16440 – 16480 AND BELOW THIS LEVELS NIFTY BECOME WEAKER .TRADERS LOOK CAUTIOS AHEAD OF RBI MPC MEET ON JUNE 08 . FRESH ROUND OF SELLING POSSIBLE ONLY BELOW 16440 AND ABOVE WHICH NIFTY COULD MOVE UPTO 16700 -16800 . NIFTY 60 MIN : AFTER DRIFTING LOWER TOWARDS 16440 LEVELS , NIFTY BOUNCED BACK TILL 16600 . ITS LIKELY THAT NIFTY TRADE IN RANGE TILL RBI MPC OUTCOME . TODAY IS NOT GOOD DAY TO DAY TRADERS AS NIFTY DID NOT MOVE MUCH AND VOLUME ON NSE WERE MUCH BELOW RECENT AVERAGE WHICH SUGGEST DIRECTIONAL MOVEMENT IS POSSIBLE ONLY AFTER RBI MPC OUTCOME . ON TECHNICAL FRONT , NIFTY FACE STIFF RESISTANCE AT 16700 AND ON DOWNSIDE SUPPORT AT 16440 . SECTOR PERFORMANCE : ONLY NIFTY METAL SECTOR END IN POSITIVE +01.12% . ALL OTHER SECTORS LOOKS FLAT , EXCEPT REALITY AND MEDIA FELL MOST. BROADER INDICIES : ALL MAJOR BROADER INDEX TRADED MIXED , NIFTY MIDCAP 50 & SMALLCAP 100 DOWN BY -0.47% & -1.02% RESPECTIVELY. TRADE PLAN FOR 07/JUNE : SHORT POSITION CAN BE CREATED BELOW 16440 WITH STRICT STOP LOSS AT 16490 AND TARGET AT 16380 . FOR LONG POSITION , BETTER TO WAIT TILL RBI MPC OUTCOME . BULLS WILL KEEP AN EYE ON 16800 LEVELS WHICH IS VERY CRUCIAL FOR JUNE MONTH FOR LONG SIDE MOMENTUM .

2022-06-01

NIFTY ANALYSIS

NIFTY TRADING IN RANGE 16485 - 16700 , IF NIFTY CLOSE ABOVE 16700 , THEN ONLY UPMOVE WILL CONFIRMED TILL 16950 . ANY CLOSE BELOW 16485 MAKES NIFTY WEAKER

2022-05-24

BANKNIFTY ANALYSIS

IT LOOKS BANKNIFTY LIKELY TO TRADE IN BROADER RANGE FOR THIS WEEK 33000 - 34820 , ANY CLOSE ABOVE 34820 LEVELS CAN MOVE TOWARDS 35250 . ANY CLOSE BELOW 33000 WILL SUGGEST THAT TREND TOWARDS 32000 IS IN PLACE

2022-05-17

WHAT TO LOOK FOR BEFORE ENTERING TRADE

" LISTEN TO WHAT THE MARKET IS SAYING ABOUT OTHERS , NOT WHAT OTHERS ARE SAYING ABOUT THE MARKET "

2022-05-16

ADITYA BIRLA FASHION - STOCK ANALYSIS

ABFRL - TAKEN GOOD SUPPORT AT WEEKLY TRENDLINE , ONE CAN START ACCUMULATING SLOWLY THIS STOCK IN THEIR PORTFOLIO .

2022-05-10

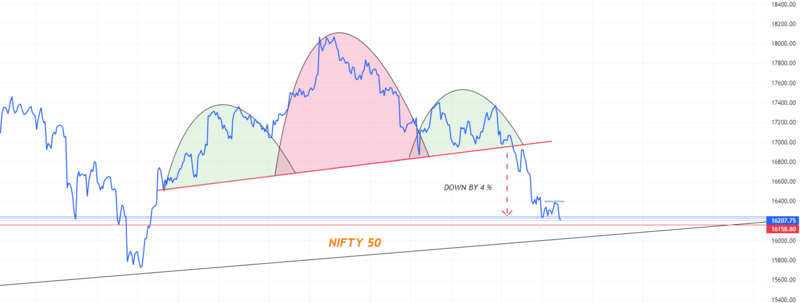

UPDATE : AS ANALYSED ON NIFTY ON MAY 05

AS ANLYSED ON MAY O5 ABOUT NIFTY PATTERN , IF FELL DOWN BY 4 % IN 3 TRADING DAYS

2022-05-05

NIFTY - HEAD & SHOULDER PATTERN

NIFTY - ON 1 HR TIME FRAME , HEAD & SHOULDER PATTERN FORMED . SO TECHNICALLY NIFTY STILL SHOWING WEAKNESS

2022-04-28

BANKNIFTY ANALYSIS

BANKNIFTY - STILL LOOKS WEAK , IF IT CLOSES ABOVE 36600 THEN ONLY IT WILL BE STRONG & NEXT RESISTANCE WILL BE AT 37300

2022-04-25

HEAD & SHOULDER PATTERN & HOW TO TRADE

TODAY USOIL FORMED HEAD & SHOULDER PATTERN , HOW TO TRADE : 1) ONCE IT GAVE BRAKEDOWN FROM PATTERN 2) OR WAIT TILL IT RETEST THE PATTERN & FORM SELLING PRESSURE CANDEL

2022-04-20

BANKNIFTY ANALYSIS

BANKNIFTY - TAKING SUPPORT AT LONG TERM TRENDLINE 36070 - 36190 , IF BN CLOSES ABOVE 36500 , NEXT TARGET 37000 & 37300 . IF BN CLOSES BELOW 36060 , THEN IT BECOME VERY WEAK & TARGET WOULD BE AT 35100 .

2022-04-12

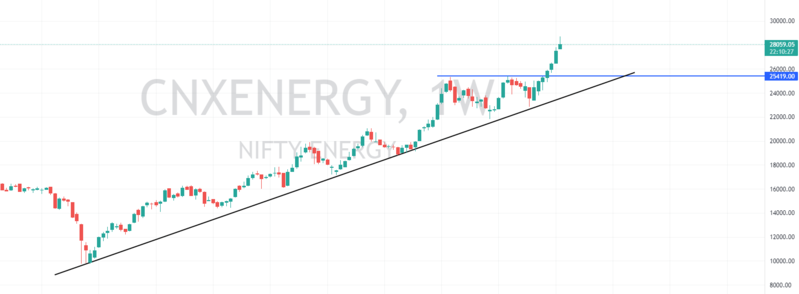

UPDATE ; AS ANALYSED ABOUT ENERGY SECTOR ANALYSIS ON 22 / MARCH / 2022

FROM 22 / MARCH / 2022 ONWARD , ENERGY SECTOR GAVE 13% UPSIDE MOMENTUM . & AS DISCUSSED ABOUT ENERGY SECTOR STOCKS , POWER GRID WENT 14% UP , RELIANCE WENT 8.60 % , TATA POWER WENT 27 % UP

2022-04-06

LIC HOUSING FINANCE - SWING CASH TRADE

LIC HOUSING FINANCE - LOOKING GOOD TO TAKE LONG POSITION IN CASH SEGMENT FOR SHORT TERM WITH TARGET AT 430. * FOR EDUCATIONAL PURPOSE ONLY

2022-04-04

UPDATE : AS ANALYSED ON 29/MAR ABOUT NIFTY TARGET LEVELS

AS ANALYSED ON 29/MAR ABOUT NIFTY - TODAY ON 04/APRIL OUR NIFTY TARGET 18000 REACHED . APROX 670 POINTS CAPTURED IN NIFTY IN 4 TRADING DAYS

2022-04-01

BANK NIFTY ANALYSIS

TODAY BN CLOSED ABOVE MAJOR RESISTANCE AT 36700 , FROM NOW ONWARDS LOOK FOR LONG OPPURTUNITY IN INDEX FUTURE & OPTIONS AND ALSO TRADERS CAN START TRADING IN STOCKS FOR SWING TRADE .

2022-03-29

NIFTY IN RANGE BOUND

NIFTY TRADING IN RANGE FROM PAST 8 TRADING DAYS , IF IT GAVE BREAKOUT AND CLOSE ABOVE 17460 ON DAILY CANDEL , THEN DEFINITELY WE CAN EXPECT 17800 - 18000 LEVELS IN COMING DAYS .

2022-03-22

ENERGY SECTOR ANALYSIS

ENERGY SECTOR INDEX ABOUT TO GIVE BREAKOUT ,, IF IT GIVE BREAKOUT IN COMING DAYS , WE CAN SEE GOOD UP MOVE IN ENERGY SECTOR STOCKS LIKE ONGC , POWERGRID , RELIANCE , TATA POWER etc

2022-03-17

NIFTY ANALYSIS OF 14 / MARCH

AS ANALYSED ON 14 / MAR /22 ABOUT NIFTY PATTERN , NIFTY WENT 400 POINT UP FROM 16900 ( 14/MAR ) TILL 17300 ( 17 / MAR )

2022-03-14

NIFTY PATTERN

ON 14 / MARCH , NIFTY 50 HAS GIVEN BREAKOUT FROM DESCENDING PARALLEL CHANNEL , TECHNICALLY ITS A GOOD SIGN TO GO LONG .

2022-03-10

COLPAL - STOCK ANALYSIS

COLPAL - IT WAS TRADING IN RANGE FROM NOV /2021 , NOW ITS ABOUT TO GIVE RANGE BREAKOUT , IF GEOPOLITICAL TENSION EASE , THEN ONE CAN START ACCUMULATING COLPAL IN THEIR PORTFOLIO

2022-02-14

WHY ? BANKNIFTY ON 14/FEB FELL BY 4 %

MACRO ECONOMIC REASONS : 1) HIGH INFLATION 2) FED INTEREST RATE HIKE 3) HIGH CRUDE PRICE 4) GEO POLITICAL TENSION ( RUSSIA & UKRAINE ) TECHNICAL REASONS : 1) ON FRIDAY , BN GIVEN RANGE BREAKOUT 2) TODAY IT BROKEN MAJOR TRENDLINE SUPPORT & STARTED TRADING BELOW IT

2022-02-08

BANK NIFTY ANALYSIS

On Feb 08 , Bank Nifty took Support @ 1 hour Long Term Trendline . Look For Long Opportunity

2022-02-02

AU BANK

AU BANK ON WEELY TIME FRAME - LOOKING GOOD TO BUY . IT HAS GIVEN BREAKOUT ON WEEKLY TIME FRAME . USE BREAKOUT & RETEST METHOD TO GET GOOD RR RATIO. DISCLAMIER ; For Educational Purpose Only

2022-01-27

BANKNIFTY ANALYSIS

BANKNIFTY FORMING TRIANGLE PATTERN ,,,WHERE EVER IT BREAKS , ONE CAN EXPECT BIG MOVEMENT IN THAT DIRECTION

2022-01-25

NIFTY PATTERN BEFORE BUDGET 2022

BEFORE BUDGET FEB/2022 - ON 25/JAN , NIFTY TAKEN SUPPORT @ LONG TERM TRENDLINE SUPPORT 16950 . ..... THIS MONTH IS CRUCIAL TO DECIDE , ARE WE HEADING TOWARDS FRESH NEW HIGH OR FALL TILL 16000.

2022-01-21

NIFTY WEEKLY ANALYSIS - 24/JAN TO 28/JAN 2022

NIFTY WEEKLY RESISTANCE @ 17720 & SUPPORT @ 17480. * IF NEXT WEEK , ABOVE RESISTANCE OR SUPPORT BROKEN ON DAILY CANDEL , WE CAN TRADE IN THAT DIRECTION UPPER TARGET @ 18100 LOWER TARGET @ 17350 DISCLAIMER ; For Educational Purpose Only

2022-01-19

NIFTY 50 PATTERN IN 2021

In 2021 - Nifty formed below 4 patterns in weekly time frame 1) pole and flag. 2) range bound. 3) head & shoulder. 4) W pattern.

2022-01-16

NIFTY WEEKLY ANALYSIS - 17/JAN TO 21/JAN - 2022

WEEKLY RESISTANCE : : R 1 - 18350 R 2 - 18600 WEEKLY SUPPORT : : S 1 - 18210 S 2 - 18120

2022-01-13

METAL SECTOR ANALYSIS

TODAY METAL SECTOR GIVEN BREAKOUT WITH GOOD BULLISH CANDEL , EXPECTING TATA STEEL , JINDAL STEEL , JSW STEEL ,HINDALCO WILL GIVE GOOD UPMOVE IN COMING DAYS

2022-01-12

DALMIA BHARAT LTD

THIS STOCK HAS A TENDENCY TO GIVE 15 - 20 % UPMOVE ONCE IT GAVE BREAKOUT FROM 1 MONTH CONSOLIDATION . TARGET - 2300 * FOR EDUCATIONAL PURPOSE ONLY

2022-01-11

NIFTY ANALYSIS

NIFTY 50 - Trading in Parallel Channel , wait till Price Reaches Lower Parallel Line & see how Price behaving their & then only make a Trade Plan accordingly

2022-01-07

TATA POWER ANALYSIS

TATA POWER ANALYSIS :: If Tata Power Breaks the Resistance Zone 230 - 235 & Sustain on Daily Time Frame over it with good Volume , then its a Ascending Triangle Breakout Pattern. TARGET - 260 SL - 217 DISCLAIMER : For Educational Purpose Only

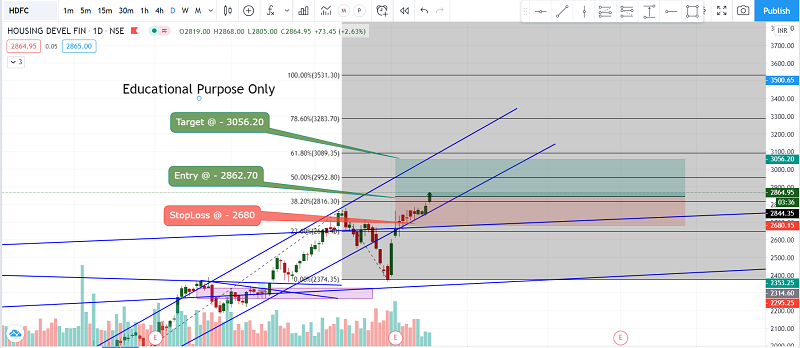

2021-02-15

Housing Devel FIN

The stock seems to be on the verge of breaking out of a long-term trendline resistance. More upside expected in the coming days.Also, the housing market could be poised for a recovery. As a result, housing finance as a sector can outperform going forward

2021-02-16

NIFTY ANALYSIS

NIFTY - Though there was a range breakout , expected a slight retracement from resistance level till the top layer of range bound.

2021-02-03

Canara Bank

Canara Bank : AThis looks very strong on all time frames. Also it given a trend line breakout on all timeframes and also triangle breakout.